The 2024 US Expat Finance Conference kicked off with a comprehensive presentation by Mary Louise Serrato, Executive Director of American Citizens Abroad (ACA), on the group’s ongoing efforts to address the complex tax issues faced by Americans living overseas.

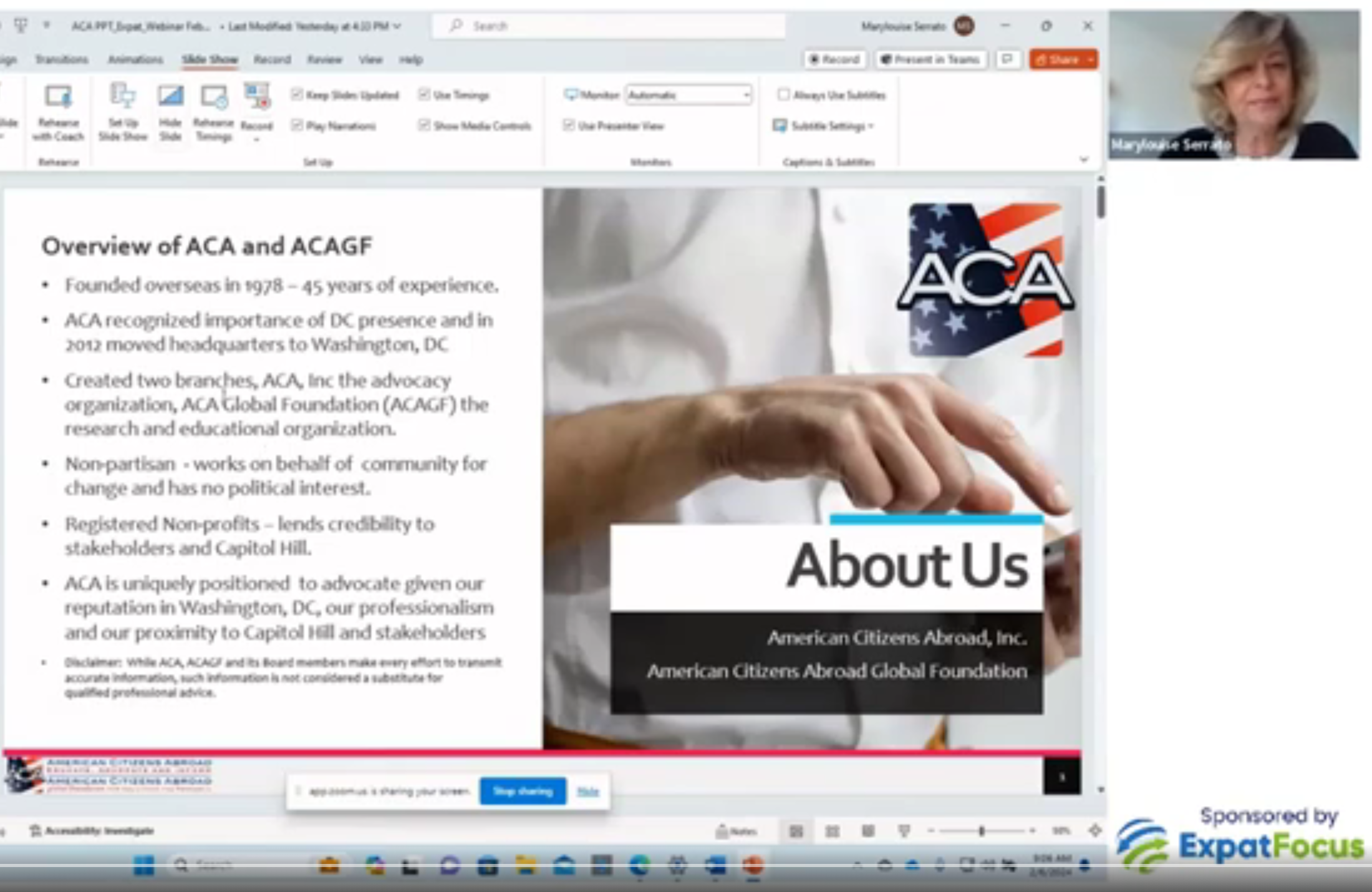

Serrato began by introducing ACA, a non-partisan advocacy organization founded in 1978 to represent the interests of US expatriates. The group is uniquely positioned to advocate for legislative reforms, thanks to its established presence in Washington D.C. and close relationships with key decision-makers, including the Joint Committee on Taxation, US Treasury Department, and House Ways and Means Committee.

At the heart of ACA’s mission is the push for Residence-Based Taxation (RBT), a system that would tax individuals based on where their income is earned, rather than their citizenship status. According to Serrato, RBT is the solution to the myriad tax compliance and investment challenges that US expats grapple with under the current Citizenship-Based Taxation (CBT) regime.

Serrato outlined ACA’s research-driven approach, which has been instrumental in augmenting the limited data available to congressional offices on the expat community. ACA’s estimates suggest that out of the 5.2 million US citizens living abroad, 4 million are civilians, of which 2.4 million are tax compliant, and 1.6 million do not file returns, often due to misunderstandings about the Foreign Earned Income Exclusion (FEIE) and foreign tax credits.

While advocating for the comprehensive overhaul of RBT, ACA also supports incremental legislative measures that could provide temporary relief to expats. Serrato highlighted several bills currently under consideration, including the Commission on Americans Living Abroad Act, the Tax Simplification for Americans Abroad Act (Bayer Act), the Overseas Americans Financial Access Act, the Earned Benefits Equality and Family Reunification Act, and the Social Security Fairness Act.

Serrato emphasized the importance of supporting these initiatives, even if they fall short of implementing RBT, as they demonstrate to Congress that the issues facing expats are not niche concerns and encourage further action.

ACA’s strategy for 2024 includes continuing research efforts, lobbying key tax-writing committees, increasing membership in the Americans Abroad Caucus, pushing for congressional hearings, and leveraging partnerships within the RBT Coalition, which includes organizations like AmChams and the Taxpayer Union.

Serrato urged expats to join ACA’s writing campaigns, as these personalized appeals have proven effective in gaining traction with congressional offices. She also highlighted the benefits of ACA membership, which include access to an online US bank account through the State Department Federal Credit Union, a valuable resource for expats facing banking lockouts due to compliance regulations.

As the polarized political climate in Congress remains a concern, Serrato expressed optimism that the expat tax reform efforts could gain bipartisan support, as the issue is fundamentally about good tax policy, rather than partisan politics.

The presentation underscored ACA’s critical role as a dedicated advocate for US expats, leveraging its expertise, research capabilities, and strategic positioning to push for long-overdue tax reforms that could alleviate the complex financial burdens faced by this often-overlooked community.