Growth In Expat Buy To Let Mortgages

Growing numbers of British expats looking for a buy to let mortgages has led to a new high in demand, says one firm.

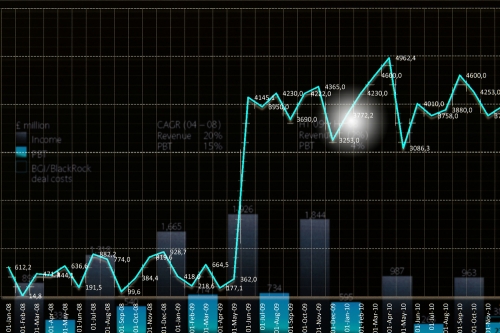

Research from Liquid Expat Mortgages reveals that over the past year demand has soared, with enquiries for UK buy to let mortgages increasing by 90 percent. This is despite stricter stress-testing regulations introduced by the Prudential Regulation Authority, which is part of the Bank of England. However, thanks to a weak pound, the UK’s property market is an attractive investment opportunity for many expats. The firm says that most enquiries are from expats in the UAE, who account for 30 percent of the total, with 15 percent coming from Hong Kong and 10 percent from Singapore.Stuart Marshall, managing director of Liquid Expat Mortgages, said: “Over the last 10 years, few lenders were providing mortgages to expats, but that’s changed thanks to increasing demand from expats wanting to invest in buy to let UK property.” He added that expats are increasingly keen to retain a foothold in the UK, and pointed out that since yields on rental properties are better than those offered in most other countries, there is still enthusiasm for owning property in the UK.

Meanwhile, offshore bank Skipton International has unveiled a boost to its expat buy to let remortgage offering. This financial firm says decisions in principle can be given over the phone and an application can be processed in just 16 days.

Landmark Tax Court Win

Expats from the UK who are living overseas and have permanently cut their ties with the country will benefit from a landmark tax case. The High Court of Justice has ruled that HM Revenue and Customs has limited powers to investigate the affairs of expats and those who are non-resident for tax purposes.

The announcement follows a case in which HMRC tried to issue a production notice at an expat’s Dubai residence – despite his being a non-UK taxpayer and having lived outside the UK for several years. The expat had cooperated with HMRC over his residence status, but the High Court has ruled that HMRC does not have grounds to insist that a UK citizen living in another sovereign country must comply with orders. Instead, they must approach the expat via the appropriate tax authority.

Expats In Kuwait To Lose Bonus

News outlets in Kuwait are reporting that expats and Kuwaiti employees in the country’s ministry of information could lose their bonus this year. The ministry is considering reducing the bonus by 50 percent; an announcement will be made soon. Those who will be affected work in the political and news sections of Kuwait’s radio and TV stations. The ministry is looking to reduce costs in the face of falling budgets.

Tax Reform Bill

While the first draft of a new tax reform bill does not address the concerns of US expats, various organisations say they still hope that expat needs will be met. One organisation, American Citizens Abroad (ACA), said that US expats should believe the new draft bill is good news and that ‘the game is still on’.

Recently, various organisations have been campaigning to attract attention from lawmakers about the issues connected to the way expats are taxed. Essentially, along with Eritrea, the US is the only country that taxes its citizens on the basis of their citizenship.

Now the ACA says that the tax cuts and jobs act is the first big step in decades to create territorial tax rules for businesses. They say the issue for expats will become apparent as the bill makes its way through congress. A spokesman for ACA said: “They will see that territorial treatment for individuals should be added.”

Increasing Renunciation Of US citizenship

With one report by Bloomberg stating that the renunciation of US citizenship still on the rise, it’s highly likely that lawmakers will address the issue. Data from the treasury department reveals that the numbers this year will top those recorded last year, when 5,411 people renounced their US citizenship, which was a 26 percent rise from the year before. Early predictions for 2017’s total say it could be as high as 6,813.

In addition, the Financial Times reports that Kevin Brady, republican head of the house ways and means committee, said that congress is now actively considering approving a move for territorial taxation for US individuals.

Taiwan Tax Perks

Taiwan has unveiled a raft of perks to attract skilled foreign expats to their shores, with a 50 percent tax cut leading the way. The country is also relaxing its rules over visas, residency and temporary stays as well as expat employment rights.

Those expats earning more than $99,340 (£75,070) can reduce their taxable income by 50 percent over the first three years of their residence in Taiwan. Work permits will also be extended to five years rather than three, and expats professionals will, for the first time, be eligible for social security.

New Zealand Property-Owning Restrictions

Expats wanting to buy a home in New Zealand are being urged to act quickly after the new Prime Minister, Jacinda Ardern, announced that anyone who was not a permanent resident or a citizen ‘will be prevented from buying existing houses’. The aim is to stop international speculators buying property and driving up prices. With migration reaching record highs, demand for property is still on the increase. According to official figures, the country has the world’s most unaffordable housing when prices are compared with local incomes.

Caymans Expat Exodus

Employers in the Cayman Islands say they are seeing an exodus of expat employees, though the impact on industry and businesses is varied. The mass departure is being blamed on expat workers wanting to leave before the government closes a pensions law loophole that allows an expat to ‘cash-out’ their retirement savings before they leave the Cayman Islands.

The hotel sector has been particularly hit hard, and a deadline for leaving at the year-end means many firms could be losing more expat employees before then.

Lack Of Financial Aid For Amsterdam Expats

A survey has revealed that professional expats heading to Amsterdam are receiving little financial aid when it comes to housing and schooling costs. Despite the growth in popularity of the Dutch city, findings from the International Community Advisory Panel (ICAP) found that 63 percent of expat professionals have little assistance from employers with school fees. Further, 77 percent of expats said they received no housing payments. The Netherlands is increasingly popular with companies as a post-Brexit location, leading to extra demand for schools and rising house prices.

Undeclared UK Earnings Warning

The Association of Taxation Technicians (ATT) has warned taxpayers who have undeclared UK earnings from offshore interests that they have less than a year to avoid being hit with hefty penalties. The association says that the UK’s Requirement to Correct (RTC) legislation, which is part of the second Finance Bill, has been reintroduced.

While the new law has still to reach the statute book, taxpayers are risking a 200 percent penalty of the tax at stake if they fail to correct their position by the end of September next year. The ATT warns that HMRC has the power to publicly name and shame affected taxpayers.

The co-chair of the association’s technical steering group says that the organisation is fully behind the UK’s commitment to tackling offshore non-compliance on tax. Yvette Nunn says that the RTC is a big change in direction for HMRC, which has previously offered incentives for taxpayers to bring their tax affairs up-to-date. She explained: “Threatening a taxpayer with a large penalty is a change in approach. We encourage taxpayers with offshore interests to review their affairs as soon as possible, with a view to being satisfied that their tax position is up-to-date, or making the necessary disclosures to HMRC.”

Shanghai World's Most Expensive City

Shanghai has now been overtaken by Hong Kong to become Asia’s most expensive city for luxury living, according to a report. The wealth report by private bank Julius Baer looks at the prices being paid by those with a high net worth of at least $1 million. Their findings show that the cost of luxury living has increased by 1.46 percent in the region, and that there’s now a sustained demand for luxury goods and services.

In Hong Kong, the cost of services and goods rose by 1 percent over the last year, despite soaring residential property prices. Hong Kong is also Asia’s most expensive city for business class flights and fine dining.

In Other News

Of all the European Union member states, Portugal receives the largest expat remittances of €3.3 billion, says Eurostat. In second place is Poland with €3.01 billion, the United Kingdom with €2.45 and Romania on €2.44 billion.

Omani landlords have been told by the government that with 5,000 educated expats leaving the country in the first six months of 2017, thousands of new Omani jobs will help boost the country’s rental market. This is because rents have fallen around the country, in some areas by as much as 30 percent.

America’s Association of International Educators has stated that expat students in the US contribute nearly $37 billion to the country’s economy and support 450,000 jobs, which is a 12.5 percent increase on last year’s figure. In addition, around three jobs are created in the states for every seven international students enrolled by higher education institutions.

Authorities in Tokyo are looking to redraw the law that compels long-term expats living there to an inheritance tax of up to 55 percent on all of their worldwide assets when they die. Critics say the law currently prohibits expats living in Japan over the long-term. The announcement follows a decision by Tokyo to promote the city as an international financial hub.

A private equity firm says that Chinese investors are snapping up education assets overseas in a bid to meet growing demand from Chinese students. Citic Capital says that Chinese expats are increasingly heading overseas to complete their education.

Dubai-based Orient Insurance has teamed up with Allianz Partners to offer expats a range of health insurance plans which will complement the mandatory Dubai health authority’s requirements, particularly for expats moving to Dubai.

Qatar has announced that it is relaxing the banking rules for expats following mounting pressure from other countries. The new rules will see expats with expiring visas being able to conduct bank transactions for 90 days after their visa expires. The rules governing foreign exchange regulations have also been relaxed.

A bid to reduce traffic congestion in Kuwait could see expat motorists being charged KD1,200 (£3,000/$3,971) every year, if one lawmaker has his suggestion taken up. The new MP says traffic jams will be resolved with fewer expat motorists on the roads. Those expats working as private drivers for families will be spared from paying the fee.

Monaco’s National Council has unveiled a law that will establish a legal right for expats residing in the principality to open a bank account with any credit institution based there, whether it’s for business or personal purpose.

In a bid to reduce traffic, Singapore has bumped up the licence fee for all vehicles so an expat wanting to drive will now, on average, be paying $80,000 for the privilege of getting behind the wheel of a new car. Authorities have also invested huge amounts in public transport and increased use of road tolls.

Non-domiciled people in the UK are being urged to take out life cover after changes to how their UK residential property is taxed. The finance bill will mean any non-dom who owns residential property in the country – either through a company, partnership or an offshore trust – will now be liable for inheritance tax (IHT). AIG Life says that billions of pounds in IHT liability has been created, meaning non-doms need to consider life cover.